(WXYZ) — The eviction moratorium ends July 31.

According to the U.S. Census Bureau’slatest household survey, nearly five million renters have no confidence they’ll be able to pay next month’s rent. This comes as the Biden Administration’s nationwide eviction moratorium is expected to end on July 31, with likely no extension. Metro Detroit financial advisor, Daniel Milan of Cornerstone Financial Services [cornerstone-mi.com], shares four tips to help those impacted catch up on rent payments. They're posted below.

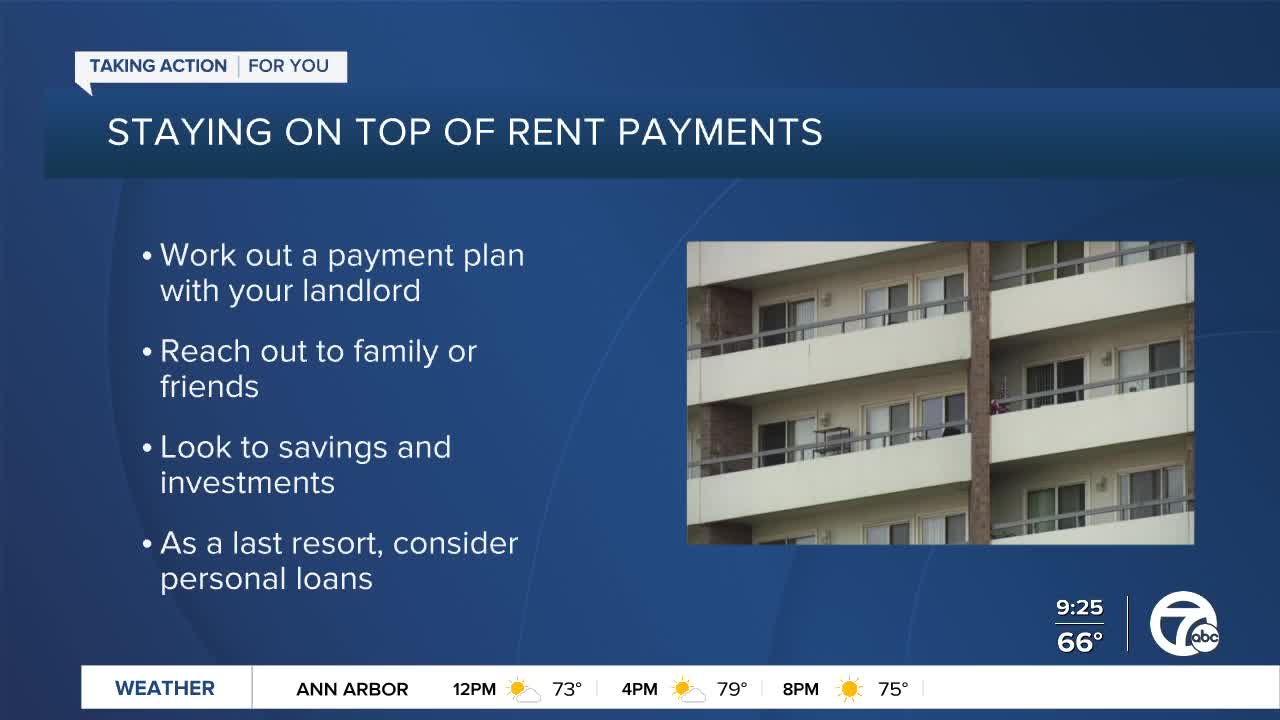

1. Work out a payment plan with your landlord. Communication is key with your landlord. Figure out what they’re willing to accept for rent. Explain your situation and see if your landlord is willing to work out a payment plan.

2. Reach out to family or friends. While this might not be the best option, it could keep you from being evicted. Ask for a loan from family or friends or start a crowdfunding campaign. If people don’t know you’re in need, they won’t help.

3. Look to investments. Pulling from investments can be a difficult decision, but being evicted could be a reason to take a withdrawal. Consider a crisis withdrawal, but penalties may apply. Pull enough to cover what your landlord is seeking.

4. Consider personal loans. This should be a last resort. Adding debt may not be the best idea, but again, it could keep you in your home. Find a loan with the lowest possible interest rate. Only borrow what you need and make sure you can make the monthly payments.