(WXYZ) — As inflation puts pressure on families, more may find themselves turning to payday loans for help. But some say the law allows predatory payday loans in Michigan, and that it needs to change.

The non-partisan Michiganders for Fair Lending says it has submitted more than 400,000 signatures to get payday loan regulations put on the ballot in November.

It was a pothole that caused a major financial bump in the road in Amber Wyatt’s life. Her car needed repairs.

"I thought it was something simple so I took it to the mechanic. Come to find out it was something major. $715 major," said Wyatt. "I couldn’t afford to pay for it. So I had to borrow money so I could get my car so I could go to work."

She took out a payday advance in November.

"I got the money like that. The problem is you borrow $600, you have to pay back $677," said Wyatt.

She then found herself having to renew and renew that payday loan, each time getting new big fees. And life kept happening. She went on maternity leave to have her beautiful baby 4 months ago.

"We’re all just trying to survive and keep on lights and a roof and food on our kids' tables," she said.

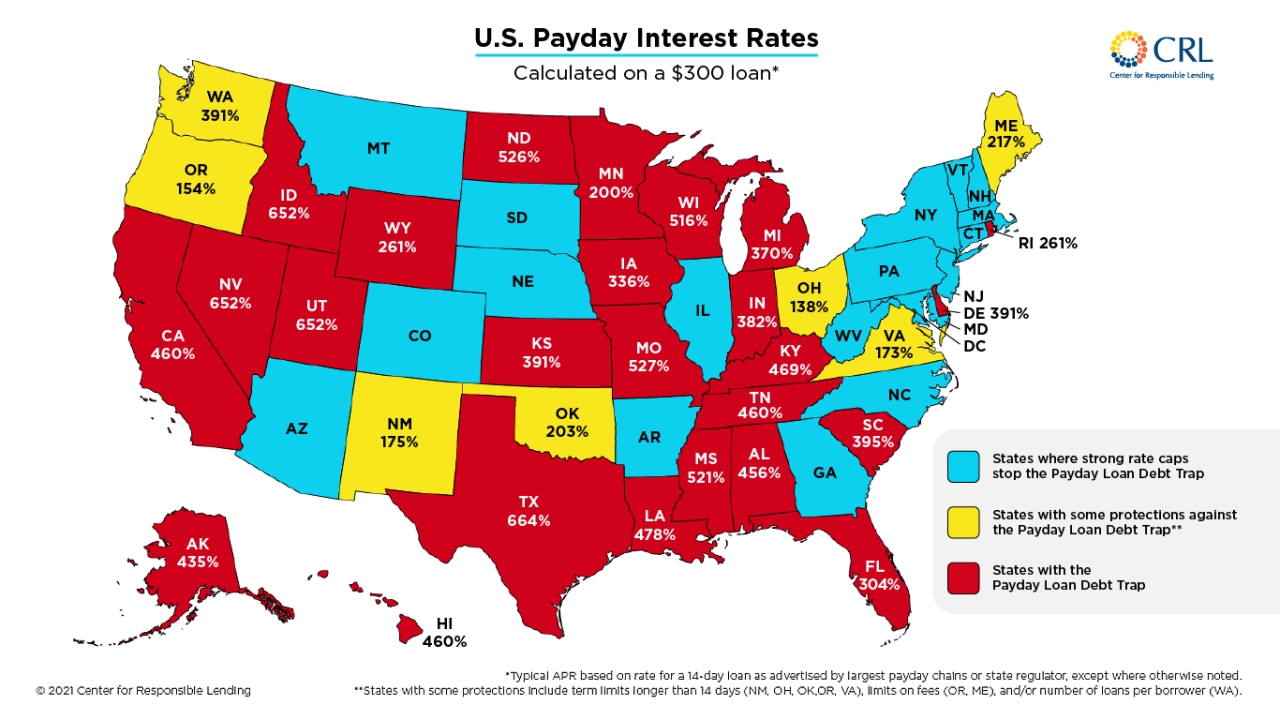

Graphic: Center for Responsible Lending

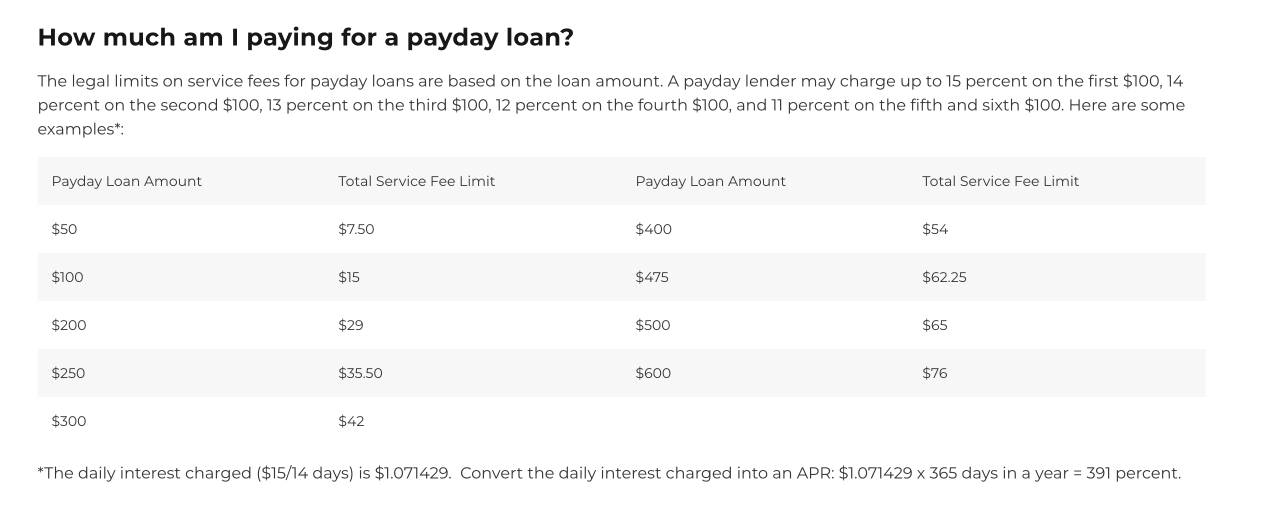

There currently are laws in Michigan restricting the fees charged on payday loans, but many don’t realize just how big the interest rates are that they are paying.

According to the Michigan Department of Financial and Insurance Services, if you borrow $100 for 2 weeks, the maximum fee allowed is $15. It may not sound like a lot, $15, if you are in a jam. But if you break it down to interest, $15/14 is $1.071429 per day. For a $100 loan, you convert that to an annual percentage rate by multiplying it by the number of days in the year. That adds up to 391 % interest a year MAX for a $100 loan in Michigan.

Source: Michigan Department of Attorney General

Now there is a movement to lower that rate with a new law.

"There are more payday loan stores than there are McDonald's," said Josh Hovey.

Hovey is the spokesperson for the Michiganders for Fair Lending campaign.

He points to a Center for Responsible Lending report that found here in Michigan, people spend more than $100 million a year on payday loan fees each year.

The Center says Michigan has what it calls a payday loan debt trap with average payday loans advertised in 2021 around 370% a year.

"It is fair to charge someone interest for a loan, but we don't think 370% should be the number," said Hovey.

Michiganders for Fair Lending has turned in more than 400,000 signatures that the state is currently reviewing. If approved, its petition would let voters decide whether they should cap the interest charged by payday lenders at 36% a year.

"That is not an unreasonable thing to be asking to not prey on people," he said.

When asked whether it would put people out of business, Hovey said, "no I think any business should be able to make money with 36% interest."

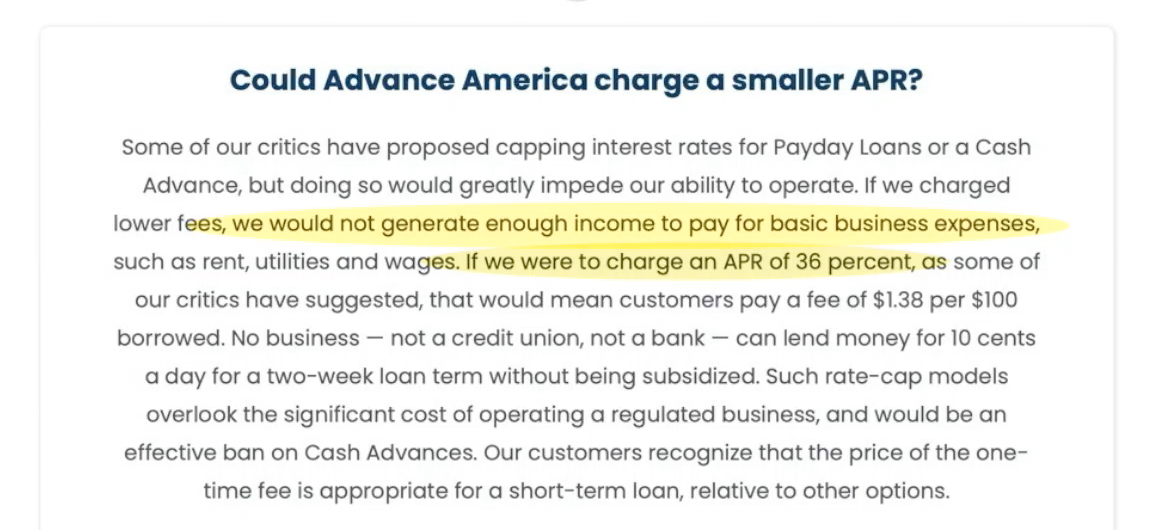

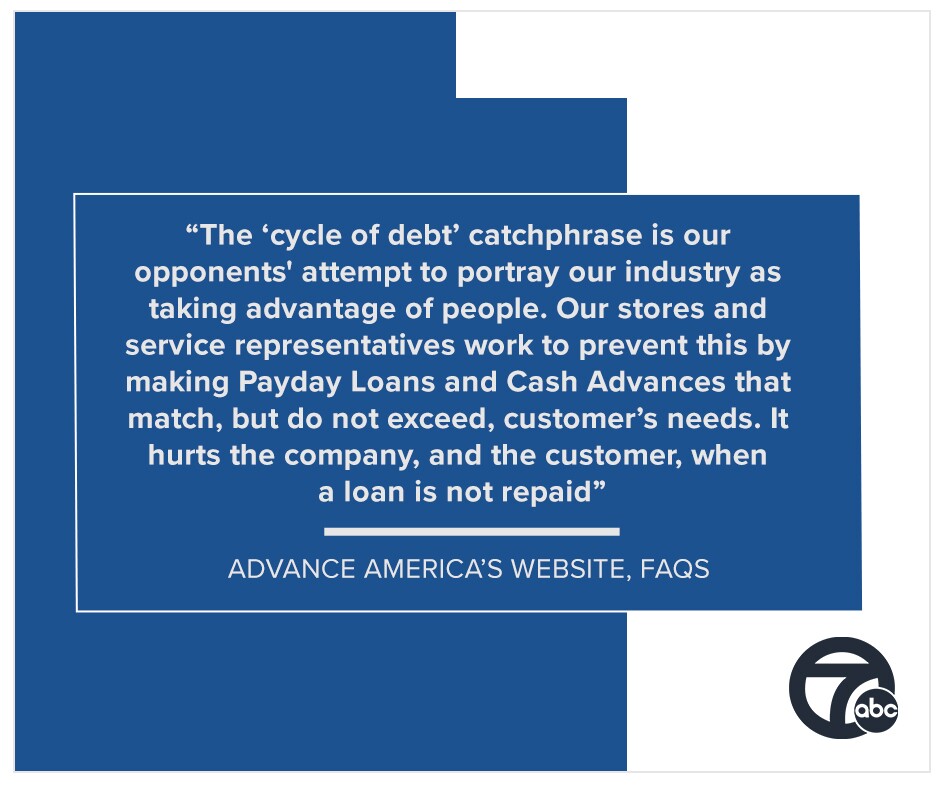

7 Action News reached out to Check N Go and Advance America for their response to such a proposal, but have yet to hear back. However Advance America’s website says its fees are sometimes less than the costs people face if they can’t take put a payday loan. It also says a 36% interest rate cap wouldn’t cover the cost of operating their business and would be an effective ban on Cash Advances.

Wyatt has mixed feelings. The payday loan got her out of a jam, even though she acknowledges it got her in a new jam.

"When you have an emergency and need money now, you don't have much choice," she said.