DETROIT (WXYZ) — We know the stock market is not the whole economy. It's merely one aspect of it. But, all too often lately we are seeing a lot of red on a lot of days. And, it has a lot of people wondering, what is about to come in our economy?

“We’re lucky; I am employed and lots of people aren’t,” said Clark Ruper, a new dad.

New parents Clark and Greta feel gratitude for what they have.

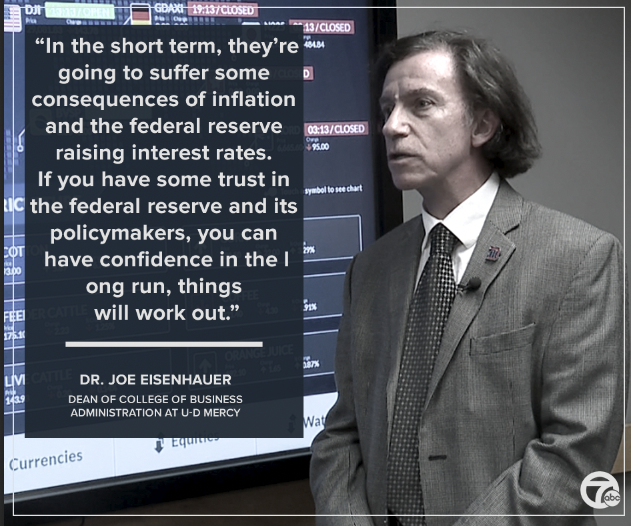

But, as the Federal Reserve raises interest rates to lower inflation they are concerned inflation may be so powerful that fighting it could lead to a recession.

In response, they saved money in safe high interest CDs, but also took on some risk hoping for reward.

“We try to invest the money where there is worth left. So, that is our strategy. Bought gold,” said Greta Kasatkina-Ruper, new mom.

“Bought gold and bitcoin and other inflation hedges, which aren’t actually inflation hedges. They are actually also dropping. So, it is kind of hard to find a good place to put your money right now," said University of Detroit-Mercy Dean of the College of Business Administration Joe Eisenhauer, who has a PhD in Economics.

“If you expect interest rates to keep going up, you want to lock in your loans right now,” said Eisenhauer.

We asked him what people can do in this kind of economy. He says if you expect a possible recession, increase your savings and if you have funds to do so, invest it in multiple places.

“Many people own a home and that is an investment. If you have money in banks, that is a type of investment. If you are in the stock market, that is another type of investment market,” said Eisenhauer.

Eisenhauer says whether you should invest in stocks or not right now depends on your risk tolerance and when you are going to need to cash out.

Historically, stocks over the long run offer higher returns than bonds or CDs, so market dips offer an opportunity to buy low.

“You will see a dip. And, if you are looking at just that moment, you will say I need to get out of it, but then right away there is a large increase,” said Eisenhauer.

But, if you are going to need money soon, say for a retirement, you might want to invest in CDs or short term bonds.

If you won’t need the savings for a year, bonds are an option.

You can buy up to $10,000 worth of I-Bonds each year through the U.S. Treasury’s website and the interest is based on inflation.

“These are backed by the U.S, Treasury. So, their risk is minimal. The current interest rate is about 9.6%,” said Professor Pratik Kothari, School of Business, Oakland University.

Oakland University Assistant Professor Pratik Kothari says the interest I-Bonds pay has been hard to match recently.

He says his research has been focused on predicting aggregate stock market returns and things, he admits, don’t look that great in the next year or so.

As a result, he invested in I-Bonds for short term returns and the stock market for the long-term returns.

“It is a long term game. Don’t be phased by current volatility,” said Kothari.

The message from both Kothari and Eisenhauer - have a long term plan to ease stress.

When asked what is the biggest mistake people make?

“Panicking,” said Kothari.

“Over time the economy will continue to operate as it normally does.”