ST. CLAIR SHORES, Mich. (WXYZ) — If you’re a business owner getting ready to file your quarterly employment tax return, you may have a lot of questions – especially when it comes to the Employee Retention Credit. I sat down with an expert so you don’t waste your money.

Businesses have faced a mountain of challenges over the past year -- from the coronavirus to the economy, complying with COVID-19 restriction to struggling to stay afloat.

And now these businesses are having to navigate the seemingly ever-changing tax landscape.

“That’s been the biggest challenge is the uncertainty I think of everything,” said Cathy Lorenz – a partner, Certified Public Accountant and tax expert at Cohen and Company in St. Clair Shores.

Lorenz said many of her clients who run businesses have a slew of questions.

“A lot of businesses are concerned because they may have already applied for forgiveness for their PPP loan – Payroll Protection Program loan – because originally you could not get both the loan and the credit. And many businesses chose the loan,” she explained.

The credit she’s talking about is the Employee Retention Credit – a fully refundable tax credit for employers who continued to pay employees even after the pandemic disrupted many of their operations.

Lorenz said the main point to remember is even if you received a PPP loan, you can go back and get the employee retention credit. Why?

The credit under the CARES Act originally expired after December 31 of 2020, but the Consolidated Appropriations Act of 2021 extended and modified the credit through June 30 of 2021.

“It could mean as much as $5,000.00 per employee for 2020 and as much as $14,000.00 per employee for 2021 for a business that is eligible for the credit,” Lorenz said.

That’s a lot of money!

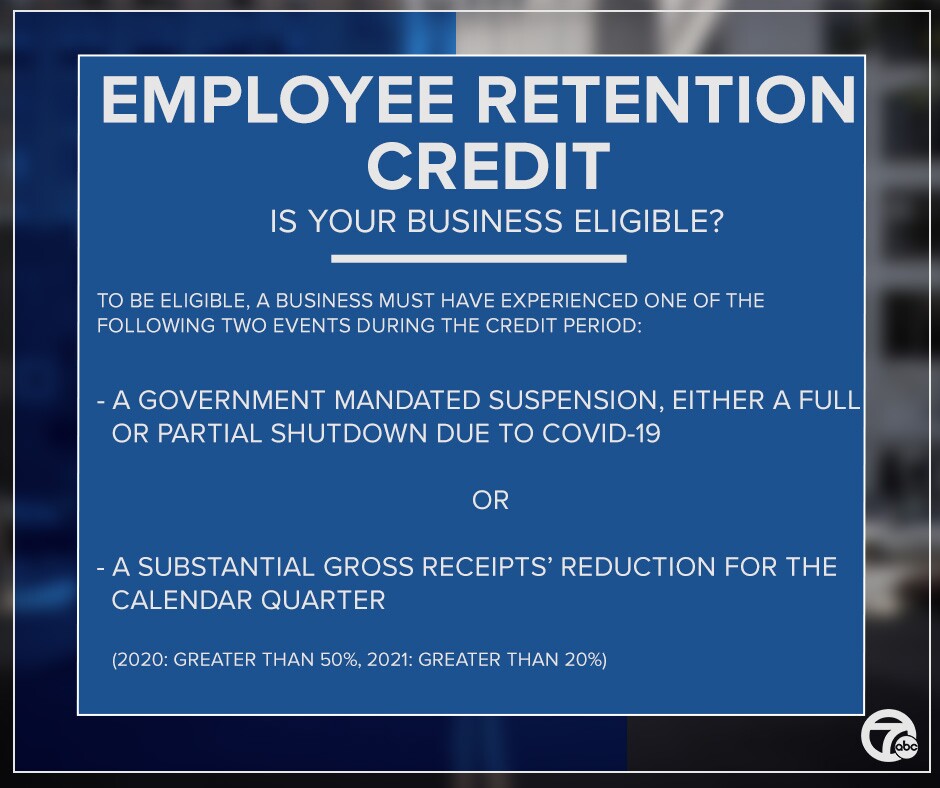

So, which employers are eligible for the employee retention credit?

To be considered eligible, a business must have experienced one of the following two events during the credit period:

--a government mandated suspension – either a full or partial shutdown due to COVID-19.

--a substantial gross receipts reduction for the calendar quarter.

We’re talking about more than a 50% reduction in 2020 compared to 2019 and more than a 20% decline in 2021.

To claim the credit, businesses must report qualified wages on your quarterly employment tax return – Form 941.

If you’ve already filed the form and did not report qualified wages, you can amend it.

If you think your business is eligible for the credit, but you’re not sure how to calculate everything, make sure you consult with a tax professional.

Now let’s talk deadlines.

Remember, last month the IRS announced that the federal tax filing deadline was being postponed to May 17, 2021?

That only applies to individual federal income tax returns and tax payments otherwise due on April 15.

But first-quarter estimated federal and state tax payments for 2021 are still due on April 15, 2021.

So, if you get your income from being self-employed or from interest, dividends, alimony, or rental income, you have to pay that quarterly estimated tax payment on Thursday, April 15.